I know that when I first started looking at YNAB as a budgeting tool, I had a bit of a sticker shock. $84 annually or $12 monthly?! As a spreadsheet queen, I don’t need to pay to budget! Wait. If I had reached a point where I was still looking for yet another solution, maybe I should sign up for the free trial.

YNAB is worth it for anyone with the following situations:

- Managing a budget with a partner

- More than 10 accounts to track (debts, banking, retirement, etc)

- You find yourself in a perpetual credit card payoff cycle

- Your privacy is important

- You want simple but you’re willing to look or log daily.

- You’re a college student (1 year free!).

We started saving over $350 a month within a matter of 2-3 months after implementing and getting the hang of YNAB based on what it showed us in a way my spreadsheets never did.

I believe in this tool so much, so just sign up! (referral link – we both get a free month if you sign up).

Or just read on to understand why these bullet points make YNAB worth it.

Managing a Budget With a Partner

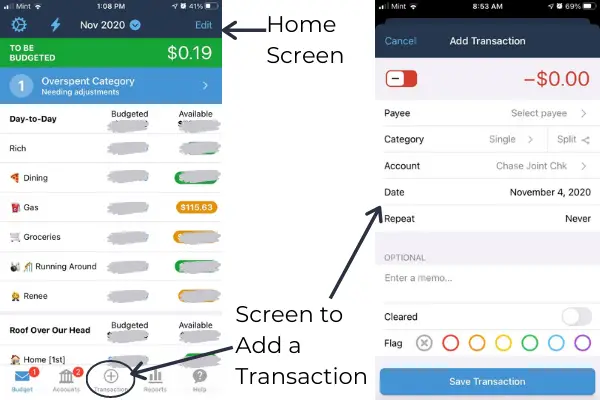

Part of what makes YNAB attractive is that there is a desktop option to manage your budget, as well as, an app for your phone. This makes it quick to toss a transaction in as you swipe a card for you and your partner, and everyone has the opportunity to know exactly where your household stands from a financial standpoint.

I must add that managing the budget in the app is not as nice as the full-featured browser, so I only manage YNAB through a standard browser. However, I do like the app to add a quick transaction on the fly.

YNAB Allows for Both of You to Add Transactions Easily

Even if your partner is not into budgeting beyond making sure they have enough to swipe the card for their gas, this is where YNAB shines. Hit the plus sign, tap a few places, and you’re on your way. Your balances are always updated even with multiple people swiping as long as you are both committed to the quick updates.

Your partner just needs to know the categories and how to check the balance if it is a question as to whether the money is allocated for the card swipe they want to do.

YNAB Allows Flexibility for Partners to Manage Their Budget

If your partner hates the idea of logging every transaction or the Big Brother feeling for their discretionary money, we’ve gotten around that by having a separate checking account for just himself. I technically have access to see the account through the banking site, so it isn’t about hiding things. I just don’t pull in any of those balances into YNAB. We just set up that the amount goes straight into that account from his check, so like clockwork, he has his spending money without having to log in or have the mental idea of everything being tracked.

If he is buying gas using a credit card, he knows to log the transaction as his way of doing his part to help us get where we want to be.

I, on the other hand, like having my discretionary information in YNAB, so I incorporate my spending money with a fund in our budget.

Find the balance that works in your household!

YNAB is Worth it for the Transparency it Gives You and Your Partner

My spouse is on board with our overarching financial plan, but he did not care about me setting up YNAB. He does know that if he is picking up groceries, he knows how to log the credit card swipe.

If he wants to head out of town for the weekend unplanned, he knows we have to sit down and look to see if we have enough or how we can.

That said, he knows where we stand at a glance with our debt, how much we have to spend at any given point, the balances of our retirement accounts, and that we are keeping all our rewards credit cards paid off even though we use them for all of our expenses.

Everyone has the opportunity to be as knowledgeable or clueless as they want to be in the budget!

YNAB is Worth It if You Have More Than 10 Accounts to Track

I will not say that YNAB was easy to learn, but I didn’t know how much I didn’t know before I started using YNAB. In my spreadsheet method, I had too many accounts to track to fully understand each account well.

I knew we paid interest, but I didn’t realize how much.

I knew we had a negative net worth, but I didn’t bother with a monthly update on how good or bad it was.

While your monthly net worth doesn’t actually change a lot of your actions each month, not knowing and not seeing the progress on the fly really kept us in the dark.

We’d have a great plan with a countdown. Then we’d do so great for 2 months. Then we wouldn’t. Rinse and repeat. We never would never ultimately get ourselves out of debt.

Now, I have a tool that doesn’t require me to do anything more than my daily tracking, and I can see the progress that we’ve made this year. I look every few months or so, and somehow YNAB as shifted our money mentality to keep our eye on the prize. So no, I will not shift money from the Transportation Sinking Fund for pizza for the family tonight.

Before, this would take a 4-hour session in front of the computer on the weekend about once a year only to beat me up with it. Now, I see progress.

So YNAB is not overall easy to grasp as a newcomer, but it does simplify the macro view of your budget. If you link your accounts, you don’t need to chase down balances all over the place.

You don’t need to spend hours updating a spreadsheet. You certainly can, but YNAB makes your unique, complex situation more accessible with very little effort beyond the setup.

Also, if you are worried about fraudulent or unexpected use of your accounts, having them linked within YNAB will allow you to monitor for activity without needing to log into each account individually.

YNAB is Worth it to End the Credit Card Payoff Cycle

Stay with me here, but have you paid off your credit cards before? Then you turn around and 6 months later, you have a balance again. You keep using the card because of the points or whatever other reason, so no worries. Maybe you throw an extra $200 on the card. Then you go grocery shopping and carry on with life. You sit back down at your next payday, and bam! It’s grown again.

That ok. I’ll get a 0% balance transfer or a debt consolidation loan. Boy, does that feel good to have just 1 payment and some zero balances to look at? Then you break out the card through budgeting practices that don’t work, for the points, or whatever other reason you tell yourself.

Now you have a loan/another credit card + fresh credit card balances. This is credit card creep.

I did this for 20 freaking years!!

This is how YNAB saved me $350 a month almost immediately. I signed up for YNAB in September 2019. I didn’t realize we were paying $350 in credit card interest every month. We were fortunate that we had access to a 0% balance transfer offer.

The difference this time is that I am over a year out with no additional credit card balances. Those cards we used for the balance transfer are still zero. This is simply because YNAB really puts it in front of your face that you need to set aside the money for what you’re buying.

YNAB makes it a conscious decision to take on more credit card debt. Check out this article from YNAB for how to deal with credit cards in YNAB. You spent the money, then you have to tell YNAB where that money will come from. If you can’t, you’re adding to the credit card balance. This is how YNAB stops the credit card creep in its tracks (as long as your motto becomes NO CREDIT CARD DEBT AGAIN!).

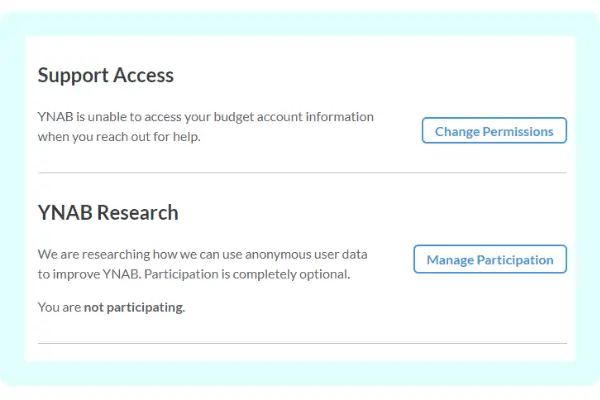

YNAB is Worth it for Privacy Concerns

There are free budgeting apps, but you know the saying about nothing being actually free, right?

Free apps stay free because they use your data to advertise or sell your data to advertisers.

My friends tend to tell me I overthink things like this, but I like to be in control as best as I can of who gets what. This was a factor that kept me from using a digitized budgeting app for years. I couldn’t see handing over $100 for a more private solution, but here I am!

First, YNAB is a paid service, so this is the revenue in their business model. They don’t need to sell your info as a way to stay afloat.

Second, you do have some control over what they do and do not see. I’m a skeptic, too, but if nothing else, they give you the illusion of some control within your account settings. You can allow or not allow YNAB support staff to see your information when you reach out for support, and you have the option to participate or not participate in their aggregated research element.

YNAB is Worth It if You’ll Commit to Maintaining it

YNAB has a bit of a reputation for being difficult to get going. Now imagine you don’t log in for weeks. It’s almost like starting over but worse because now you’re working to reconcile and categorize everything after you’ve forgotten.

That said, I spend less than 2 minutes each day just making sure everything looks ok. If you and anyone that uses your accounts will log transactions faithfully, you could limit having to log in daily. You will need to find your rhythm, so YNAB is not worth it if you are not prepared to spend time learning your rhythm and staying on top of it.

My simplified routine: Each day I log in to approve or assign transactions if they weren’t logged right. On paydays, I make sure our spending accounts aren’t too lean and allocate the available money into different accounts.

We have done a bit of the pay ahead a month out thing going on, but I generally check and pay bills 2 times a month (4 paychecks each month). That’s it.

I don’t have to spend a ton of time, but the few times I let it slide, I regretted it.

You’re More Likely to Hit Your Financial Goals

If you have a budget anywhere, you know how it is to have a list of wants or needs that you struggle to afford. The struggle is real.

Another part of the YNAB framework that has helped my family is the YNAB Wish Farm. The general idea is that you sit down & make a list of the things you wish you could afford.

Then you prioritize the list to narrow it down to a small, medium & large goal. Those are the seeds you’ll water they call the wish farm.

You decide what small, medium, and large means, but by doing this, we’ve been able to travel, get cosmetic dental work, a roof, woodworking tools, splurge workout gear, and more over the years.

YNAB is Worth It if You’re a College Student

College students get to have a free account for 12 months!!! So I feel like the best spot to really get your money’s worth out of the tool is whatever point that you’re enrolled in and making some money. Get that free account and learn to budget.

The learning curve to using YNAB was so large because I’ve been earning and spending a certain way for so many years. I wish YNAB would offer any student that is earning a paycheck the free opportunity for 12 months. Talk about setting up to learn how to manage your money well early!

Regardless, here is the link to YNAB‘s college student page to learn how to get your free 12 months.

Closing Thoughts on Is YNAB Worth It?

I believe we have to prioritize how we spend our time and money. YNAB is a priority for me, and I literally have a sinking fund/category/envelope/whatever you want to call it just for this subscription. I felt like I couldn’t afford it at the time, but I am glad I went for the free trial when I did.

I recommend YNAB whole-heartedly. Sign up to try it for free: referral link here. We both get a free month if you sign up. Just don’t forget to add an envelope for the charge next year either a single line item or a single annual subscription ‘envelope’!