Budgeting with a partner is a conversation all by itself. Throw in YNAB, and things can confusing. What about if you were to try YNAB with a partner? Yes, budgeting can be hard, budgeting with a partner can be harder, and budgeting within a tool that newbies have to shift their minds around can be even harder!

Using YNAB with a partner does require a bit of training and level setting, but you can set up goals with shared or unshared budgets. You can also make YNAB work with your spouse even if they do not want to log transactions by using YNAB’s Rule #3 to Roll with the Punches.

If you aren’t yet signed up, here is a referral link for it. We both get a month free if you do decide to sign up.

Shared Goals Using YNAB

Part of what makes YNAB so powerful in our household is that it helps us establish priorities and set goals.

We have been YNAB users for about a year and a half, and my husband still gets hung up about the budget. He recently said something in passing about how December will be tighter because of Christmas. Um. No, it won’t. We’ve been budgeting for it all year. He was carrying that imaginary burden that didn’t exist.

This is because we sat down to set goals together, and then we pretty much run on autopilot. I handle the reconciliations and make sure we stay on track, but unless priorities need to be talked about again, we set it and forget it.

So we probably need to talk a bit more frequently in the house about what our overall picture looks like, but our goals are so big they take some time to accomplish.

If you’re just starting out with YNAB, just learning to use it can be a bit of a learning curve. However, once you find your rhythm, sit down and think about what you guys would like to accomplish as a team. Is it debt payoff? What about a new patio set?

Your goals are personal, and if you work together with a partner, you’ll get there faster.

YNAB Multiple Login Issues + Workaround

So. Fun story. YNAB has you set up the account with an email address and password. That’s it. To share your budget with your spouse or partner, you have to share your login credentials.

Wait! That can’t be right! Sadly, it is. Information security issue?! Hello!? This is my biggest complaint about YNAB. I’d prefer a family plan set up that you can grant access to people that can set their own unique passwords up to it.

Anyhow. YNAB did make it so that you can tie 2 Google accounts to a login. So the account is still under 1 account, but your partner can use a Google profile to access it.

Just know that there is not an audit trail to understand who does what either.

One Account but It’s OUR Budget Hangups

I highly recommend you employ some psychology here. If your partner is not as interested in budgeting for whatever reason, the single account thing can be a turnoff. It has a mine versus yours instead of a family account vibe where access is shared.

That said, come at this from the angle that it is a household budget angle. You signed up with your account, and the security allows for merging through the Google account.

When you talk about the budget, make sure the words you use also convey the ‘us’ idea. I won’t digress since I’m talking about YNAB specifically, but your shared goals in the budget will go a long way.

You Can Still Have Separate Budgets Using YNAB with a Partner

You can have as many budgets as you want within YNAB. I personally use YNAB for personal and business. I have also set up one for my adult stepson at one point when we were helping him transition.

If you guys are comfortable sharing an account this way, you can set up 1 for each of you, and you could also set up another for a joint version if you’d like.

Transactions don’t flow between budgets. Let’s say you want to contribute $100 from your budget to the joint wish farm for a new fence. You would need to document the move out of your budget, and then you’d have a transaction in the joint budget to add it.

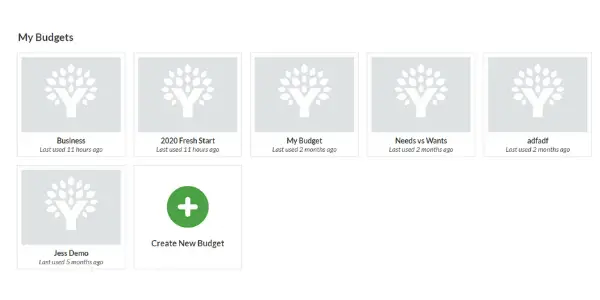

Here is how many I have out there at the moment. Granted we only use the 2020 Fresh Start and the Business one.

The Needs vs Wants was actually a priority planning session at the start of the COVID-19 shutdowns to level set what we’d do if we were to lose a job or both in the house. The My Budget was the 2019 starter before we really got our wings, the randomly named adfadf was the stepson’s budget, and the Jess Demo was to show a friend.

You can literally have as many as you want, but again, they don’t speak to each other.

You and your partner could have separate YNAB accounts altogether, but at over $80 each, I’d rather get pampered or work towards a goal with that money!

Tips to Help Get a Partner On Board

Let’s break out some more psychology here, but as humans, we are always looking out for ourselves. Of course, that doesn’t mean we do this at the expense of our partners, but if you want someone to get on board, they have to see how it benefits them.

Yes, your overarching goals may align, but sometimes that can be so abstract to a partner not on board.

This is where using a Wish Farm can be helpful and perhaps even downright powerful in your efforts.

Essentially, you save up for what you want. No brainer, right? Well, the idea is that you have a big wish list of things you would like to save for, but at any time, you are saving for 1 lower-priced, 1 mid-priced, and 1 higher-priced item at a time. Those are the seeds you water with funds to help focus & prioritize.

Is your partner looking to get a new stereo for his truck? Or are they eyeing a new road bike? Change out the desires as needed, but can you find a way to incorporate something important to your partner that feels kinda far out that you can plan for?

This was a motivator in our house. My husband wanted a compound miter saw. That had him loading in transactions, and when he got the saw and our credit card debt in the same window, he was sold. Whatever makes your honey bun tick, right?!

Whatever you do, do not force the issue. Find the rhythm in your house, but trying to force an idea on another adult is likely not going to get you very far. Psychology, after all.

Roll with the Punches Solo if Needed

One of YNAB’s foundational rules is to roll with the punches. I don’t connect with the rules overall, but it does apply here. If your partner is not up for using YNAB, you don’t necessarily need them to.

I’m all about the power of shared resources and goals to get where you want to be together, but this can be done solo, too.

Perhaps your partner is just not into budgeting. This will require some digging on your part, but is it the budget? Is it the feeling of restriction? Is it the act of having to update something when getting gas? Dive into what the hang-up is.

If you both operate out of a shared account, you can always reconcile the expenses that come through for both of you. My husband is on board, but there are windows that he just won’t update it using the app. He would certainly never log in to the desktop version ever. He is also awful at saving receipts. I just log in daily to minimize overwhelm, and it’s not a big deal in our home.

He is who he is. I do have him use a separate card, so if he has a charge for Wal-Mart, I generally know he got gas. If I use a card at Wal-Mart, I generally get groceries. Reconciling after the fact is fine.

To minimize the feeling of restriction for him, he has discretionary funds that he doesn’t have to track. I just did not connect his solo checking account to YNAB. We talked through our individual discretionary fund allowances, and they are directly deposited from his check to that checking account. He has no tracking, no-guilt spending.

I get the same amount, but mine is connected. I like to see how I spend my money.

If he wants something that is outside of his discretionary funds’ balance OR he doesn’t think it should come out of his funds, he’ll check in. He’s frugal, so that is rare.

However, we have a system that allows us to function when he is an active participant in YNAB updating yet rolls with the punches when he doesn’t. Find your rhythm, and using YNAB with a partner doesn’t have to be a big deal!