I ran across a YouTube video from the YNAB Team about the Wish Farm earlier in the year, and it has really helped me make progress on items I felt guilty to incorporate into the budget before. YNAB’s Wish Farm concept really helped make the method something we have stuck with!

The YNAB Wish Farm is a budgeting method to prioritize small, medium, and large items from a wish list. The intention is to make progress toward your wish list without spreading the money too thin and losing momentum toward goals.

Let’s walk through more depth what the wish farm is and how to incorporate it into your YNAB progress.

More About the YNAB Wish Farm

Lots of YNAB users are all about having a section in their budget that is essentially a wish list. Think of it as a Christmas list that you’d give Santa. If you won the lottery (even though you don’t buy tickets, right?), you’d buy all of these things because you want to. They are wants and certainly not needs.

You have a vacuum cleaner, but you really think one of those snazzy robotic vacuums will make you so much freer (or at least you’ll have cleaner floors). You’d also like to get a new bike, and you’ve been eyeing a new gaming mouse. Oh, the list keeps going with a truck accessory, a new dining table, and oh so much more.

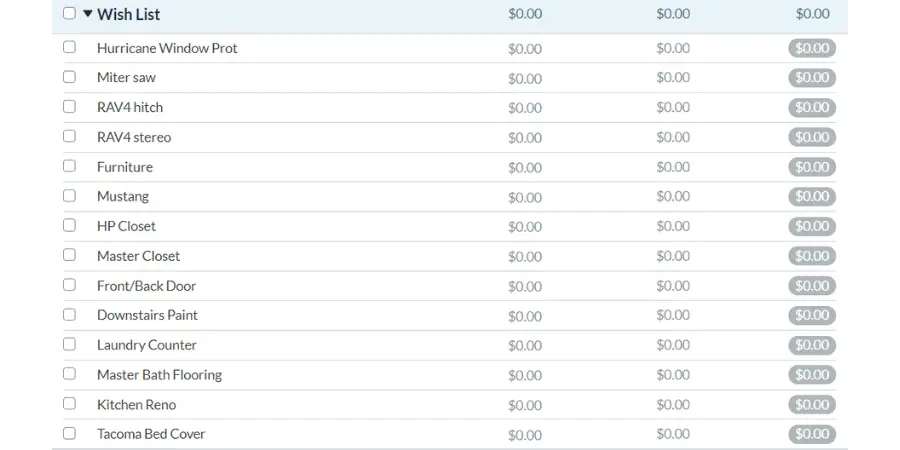

The key piece here is that the wish list has no money allocated to it. It is a running list of items that we’d like to spend money on at some point, but we are not contributing to those categories yet. It is just a list.

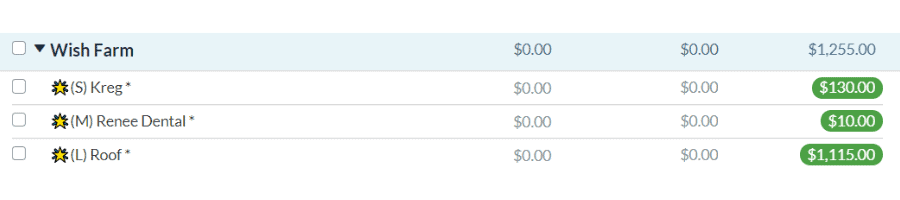

The Wish Farm is all about breaking the long list into 3 categories that are arbitrarily set to a small, medium, and large bucket based on the item’s cost. Then you pick your favorite or highest priority wish list item for each. which they refer to as a seed. You then water those seeds by funding the priorities. Essentially, you are adding funds to only 3 items that came from that wish list. When you have saved up enough for an item in the Wish Farm, you harvest the item (i.e. make the purchase.) Then you assess your wish list to plant that seed into the Wish Farm.

(Dental is new and only cosmetic in case that raises some questions for you)

Benefits of Using the Wish Farm

The wish list can get long, and you may begin to feel like you’ll never get to the point where you actually get to buy an item off of it. By having an area of focus (deemed a Wish Farm or whatever), you can start to see some progress.

Additionally, after using the method for about 6 months, I found that there were items I could remove from the list. By delaying the purchase, I never made the purchase. That is a world away from just charging the item like I may have done in the past. It’s also why I have my 72-hour rule for purchases outside of the standard day-to-day.

Our household is in debt payoff mode while also making progress on our property, so we are doing a hybrid approach to accomplishing goals. I know there are some models that throw everything at 1 big goal, but we have found that the hard-core debt payoff approach with zero fun leads us to binge spending type behaviors. By incorporating the Wish Farm style focus, we get to accomplish some not-as-high-of-a-priority wants while not deviating from that debt payoff overarching priority. Budgets are very personal, aren’t they?

Using a Wish Farm without YNAB

Even if you are not a YNAB user, the benefits of having a focus in your budget will help you achieve your goals. The same idea applies to you even if you do not use YNAB. Find 3 items from your wish list that are small, medium, or large goals for you, and only divert money to them over the 20 item wish list to achieve the same outcome.

Is the Wish Farm for Everyone?

Nope. Some people find too many categories to be overwhelming or cumbersome to maintain. If having too many categories like a wish list or wish farm will cause you to not follow through with using YNAB, you can skip it. However, if you haven’t tried it, I do recommend giving it a go without discounting it entirely.

To counteract a long, intimidating list, be sure to keep the list clean. You may find that if you do not prioritize a ‘wish’ item into the budget over a month or so that you actually do not need or want the item any longer. I like to skim the list when I am looking for a replacement when I hit the goal on an item. A quick glance to keep your list trim will minimize angst from a list that is too long.

While working towards your small, medium, and large goals, you can simply hide the Wish List category. Keep it simple!

Our First Wish List

I can not find an image that would be our actual first list. The items we have crossed off the list since implementing this strategy are listed below for fun.

- Blower

- Tarp for our camper

- Ninja Foodi

- NoxGear Vest

- Rich’s College Expenses (We used this as a medium bucket item for each of his semesters because he felt too guilty to put it as part of our normal budget. Go ahead. Shake your head. I get it.)

- Garmin Fitness Watch

- Guitar

- Master Closet Remodel

- Just bought the paint to paint the downstairs of our home

- Laundry counter

- New vacuum

Here is a list of all of the items we removed because our priorities have changed.

- Mustang

- Tacoma Bed Cover changed to Tacoma Stereo (he’d rather have the stereo now over a bed cover)

- RAV4 items because I decided I didn’t want them enough when time passed.

- Front Door replacement. We live where there are additional requirements due to windstorm insurance regulations we aren’t willing to deal with. The back door needs the replacement anyhow, so that part stayed. They were 1 line item for us before.

We’re Not Fully Wish Farm Users Now

We still have a wish list, but our focus beyond debt payoff has grown. With the addition of the property and our desire to build our life in that direction, we are just not in the mood to prioritize some things any longer.

We still have wants (like running shoes right now), and they do get incorporated. We just call it a Focus instead of a Wish Farm because it feels more intense to say Focus. In that Focus area in our budget, you’ll find the line items for the property + those running shoes.

We’re all about YNAB’s rule #3: Roll With the Punches!

What is a Small, Medium, and Large Amount?

This is an ‘it depends’ answer. The team at YNAB does not really give ranges, but really this is personal and likely influenced by the size of the items in your wish list and your income.

Right now, we are struggling because our wish list items are quite large to get the things done at the property that we would like to. I digress.

Here are some ideas to help with ranges if you need a bit more guidance than, it depends.

- Small: $0-250, Medium: 250-500, Large: 500+

- Small: $0-50, Medium: 50-500, Large: 500+

- Small: $0-100, Medium: $100-250, Large: 250-1,000, x-Large: 1,000+

If you’ll notice in these examples, I threw in an extra-large for the last one. It’s yours. At the moment, we only have 2 because the amounts are so high. In the past, we went up to $700 for a medium because our large is saving for an entire roof. You have total control, so do not box yourself in if it makes you feel constrained.

A Non-Cost Driven Method

Another way to divide into a small, medium and large category for your wish farm would be how long it may take you to accomplish the goal. If you can make the money happen in under 2 months, that could be a small, 2-6 months medium, and large would be anything that takes more than 6 months to save for.

Of course, this method could give you a good framework, don’t forget YNAB’s rule to roll with the punches. Don’t box yourself in and add stress. Keep chipping away at the goal consistently, and you’ll get there!

Additional Wish Farm Ideas

You may find that a wish farm keeps the fun alive and well in your budget, but some of these ideas could also fit into other sections of how you decide to use the tool.

For example, for the computer and phone, I account for these in a Sinking Fund category called New Tech. I think these are pretty important with how we live, and the way these expenses have occurred in my household has made me appreciate a no-guilt bucket to replace a chewed-up laptop cord.

Also, you can semi-ignore the categories because there is some significant overlap between items at times. Gaming computer components you may classify as electronics or hobbies. These ideas are just inspirations.

Fitness

I like to add fitness wants here as a way to get a splurge occasionally that will help with my motivation to keep motivated to move your body!)

- New Bike

- Running Shoes

- Treadmill

- Running Headphones. Hello, Aftershokz.

- Race entry fees

- Yoga mat

Electronics

- Computer

- New Phone (I keep this in a New Tech sinking fund)

- Gaming mouse

Household Items

- Vacuum cleaner

- Coffee/espresso maker

- Kitchen Aid Stand Mixer

- Dining table

- New fence

- House downpayment

- Office chair

Clothing/Accessories

I am one of those people with a clothing sinking fund, but I can see adding in a higher-end item from what I would normally spend included as a Wish Farm item. A standard blouse for work is different than a pair of boots to my sinking fund and how day-to-day spending is prioritized.

- Sunglasses

- New pair of boots

- New purse

Hobbies

- Camera

- Hunting Gear

- Airfare to Italy

- New board game for game nights

At the end of the day, you have to find a way to make your budget work for you. If you haven’t experimented with a Wish List and accompanying Wish Farm, it may be worth your time to give the practice a try. We are glad we did, and you can always take it out down the road if you find it doesn’t give you the mental boost you need to make YNAB work for you.

Read more about making YNAB work WITH a partner.