Budgeting for the holiday season can cause stress and anxiety. Especially if budgeting for it didn’t come up in your mind in February. It can really put a dent in the budget for the whole holiday season, or you will be unable to buy what you had hoped to in order to stay on budget.

Budgeting for Christmas in YNAB is best started at Christmas for the next year. You set up a sinking fund for the holiday by itself or in a bucket for year-round gifts in YNAB. Contribute monthly, and you will be minimize the impact to your budget next year.

No matter where we are at in the year when you stumble upon this information, let’s get you the information you need to enjoy the season with as little money-related stress as possible.

If you don’t have YNAB, sign up for the free trial using my referral link. I will be granted a free month of the service, but once I hit 12, I’ll literally host a giveaway on Instagram. I believe in this tool’s ability to help YOU that much!

Budgeting for Christmas in the YNAB Context

To make sure we’re on the same page here, YNAB is set up to fund ‘envelopes’ I’ll refer to as sinking funds to fund categories. You simply add funds to it, and when the time to pay out comes around, you simply deduct it from the sinking funds you set aside.

This applies to Christmas, too. You can set up a sinking fund, and then you contribute to it. As you start buying gifts, you’re reducing the amount available to spend in the Christmas budget.

Easy, right? This is very powerful, and the more time you have in between now and Christmas, the less it will take from you monthly.

What to Include in Your Christmas Fund in YNAB

YNAB is exceptionally flexible, so what you decide to include in the fund is entirely up to you.

I have my budget set up as gifts. It is a year-round bucket used to buy birthday gifts, dinner, or party items. This means that if we are invited to a Christmas potluck, if I need to swing by for a fancy pie on the way over, I simply pull it from this fund.

This is not a hard and fast rule. If I I’m running low in the Gifts fund, I can certainly use dining out funds instead. It’s my choice!

So the first step is to decide how you want your Christmas fund to work. Are you going to lump it with other gifts through the year, or do you like the idea of it being dedicated?

What about items you’d like to buy for extra spirit in the house? New snowman pillows light you up? Or is lighting up your house like that infamous Chevy Chase movie more your speed?

Whatever you plan to do, I like to write a few notes on a post it note to help me along in the next steps.

Determine How Much Money You Need

The next step in prepping for Christmas is to think about how much you need to allocate to the sinking fund. Don’t get too fanatical. I like to eyeball budget items that are farther out, and you can certainly adjust as it gets closer and your plans solidify.

There are three ways to go about this.

#1. If you’re a planner, you can certainly sit down and right out your Christmas gift list and what you plan to purchase. Look up how much it all is, and bam! You’re golden.

#2. If you have no clue what is on the horizon, you can certainly look to prior years to see what you’ve spent. If you are new to YNAB, this may require some digging into whatever system or credit card statements you can rummage through.

#3. Decide how much you are willing to spend. If you have serious financial goals, then this is not the year to be extravagant. This point also lends itself to have you look at what you are able to spend. If you have a tight budget, again, extravagance is for another time.

We actually used a hybrid approach. We include gifts throughout the year in my fund, so we added up everyone’s birthdays and what we tend to spend on prior Christmas’ + what we want to spend per person to take a swing at a number. Personalize the process to work for you.

Let’s dive into the specifics of what you’d like to spend against what you actually have to spend.

Now Look at How Much is Actually Available

Let’s start this topic by saying that this post isn’t about driving you into a negative spiral about the holidays, so I urge you to take the time to think about the positive things you are able to do regardless of your budget. We are just approaching this topic as if it were a business decision on a fun topic. It should be fun, after all!?

Now for the meat. Take the number you arrived at above, and then you simply divide it by the number of months until you need to start spending.

If you’re on your A-game going through this exercise with Christmas barely in your rear-view mirror, and it’s January, roll with dividing the amount by 11 months. This assumes you’ll start contributing now, and you’ll start spending in November.

Even if you’re not on your A-game, just divide by the actual number of months before you need the money. It really is that simple.

So I use the money through the year. Knowing this, we averaged the birthday/graduation/shower expense estimates for each month, and then we took the Christmas specific estimate and divided that by 11. Add the Christmas monthly number to the all-other-gifts number, and BAM! We have a number to include in our monthly process.

Add the Spending Category and a Goal to YNAB

Now, you simply add the category into YNAB. Check out this quick Video from YNAB (the experts, after all) if you aren’t sure how to do this.

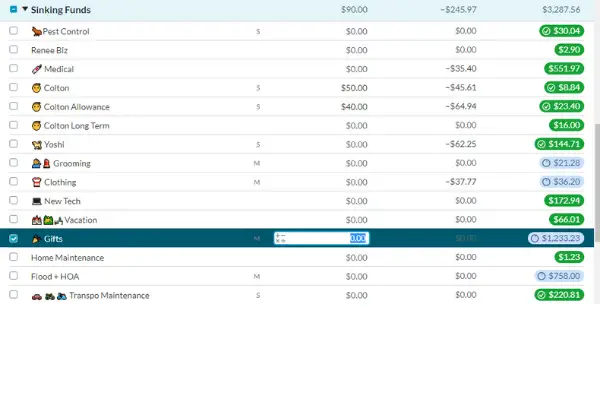

Here is how ours is laid out at the moment with the entire Sinking Funds section.

Once the category is added, you simply set a goal. YNAB really has an excellent library of videos on how the functionality of the tool works.

If you plan to only use the money in this category as the holidays approach, this link will take you directly to the place in a helpful YNAB video to set up this specific goal type with a target balance by a target date.

If you are planning to use the funds through the year for other holidays, this YNAB video steps in where you need to be to set the goal up for spending through the year (similar to how groceries works).

If you are wanting to save a specified amount each month & who cares when it needs to spent, this part of the YNAB video is for you.

Now What?

You simply contribute each month the way you do the other funds in your budget. As the holiday actually approaches, you may find that your plans have become more in focus. Do you have an updated estimate on what to spend?

Make the adjustments you need. If you are looking at a surplus, I’d leave it as a buffer for next year. If it is substantial, you can always reallocate some money to another financial goal.

If there is a shortfall, you have 2 choices.

- Pull from other funds in your budget.

- Think about how to reduce the expenses. For us, we tend to pull back on the amount we plan to spend per person OR cut people from the list.

I’m not trying to be all Scrooge here, but your loved ones do not want you to charge their gift and add to your debt. If they don’t care, they do care about what you find important, so being thoughtful to how you cut back is important, too.

Can you DIY gifts? If you’re crafty, that could reduce your budget. However, a shopping spree at your local craft stores can empty this account quick, too. I am using some ideas on this list for DIY options this year, myself.

If you are wondering if reducing the overall size of the list you have in mind is a better approach, this post from April Lee of Hassle Free Savings has some good ideas on where to prioritize people in your list. Three People, You Should Give Christmas Presents to and Three People You Should Not

Another option is to think in terms of experiences and moments with those you care for. I have a friend that would be happy to have 2 hours of time at a coffee shop (on me) and a solid, uninterrupted chat. My kiddo told me his favorite memories (so far) involve us making fudge together each year.

You likely have traditions of your own in your circle that you can appreciate. No, making fudge with my son is not the gift he’ll find under the tree, but I can make the season magical no matter what we have to spend. You can, too.